It is a difficult thing to try to get out of debt. It is better to NOT ever go into debt if at all possible. Unfortunately, we almost always go deep into debt for houses and vehicles these days. I know. I have been there. It is a miserable place to be. How did I even get here? Let me tell you how and what I did about it. I wish I would have had these 8 tools to stay out of debt back then.

When I was a young adult, multiple credit accounts were necessary to establish a good credit history. Credit was encouraged. Saving, however, was encouraged and credit discouraged in my father’s generation. My father was born just before the Great Depression. His generation was taught that with education, hard work, and saving you could have a decent life. Saving and mending everything were commonplace skills. That was then, this is now. We all need these 8 tools to get out of and stay out of debt.

A Lasting Impression

I remember one particularly cold snowy winter growing up in northern Ohio. Our furnace was about to go out. My Dad knew this and started saving to replace it. The furnace regrettably went out before the total amount needed to replace it was saved. With 50% cash in hand, my Father went all over town trying to finance the rest of the money he needed to replace our furnace so we could have heat. Not a single bank nor store would finance the difference because my father had no credit history. He always paid cash.

Thankfully, he was able to borrow the difference from a friend. At what cost, I have no recollection. This made a deep impression on me. I felt I needed to establish credit as a young adult in a time where many accounts were needed to do so. I saw paying everything in cash as a handicap. The internet didn’t exist. Dad’s best advice was just to save. I didn’t see that as effective and went the opposite direction breaking every one of these 8 tools without thought.

Enslaved To Debt

Establishing multiple credit accounts was easy until multiple bills came along with that noble idea. Unfortunately, high school skills did not prepare me to budget, nor count the interest that is applied to what you borrow. Banks made a lot of money off me. Though it was fun to go into a store, lay that plastic card down, and walk out with whatever I wanted at the time. That fun ended when it came time to pay the bill. After paying my cards off I would go right back to them and charge again. Debt enslaved me. That debt was almost impossible to break free from. Finally, I had had enough to get serious. These are the tactics I learned. These 8 hard-learned debt-free tools can be used by anyone to begin the journey to becoming debt-free.

Break Free From Debt Now Tools

- STOP CHARGING TODAY! If you don’t have the cash to buy it outright then don’t buy it. Make do without it or pay cash! Live within your means.

- Write down the interest that you are paying on each payment going out each month. What is the interest rate that you are being charged? Write it down too! Find a way to reduce it TODAY!

- Learn how to make a budget TODAY!

- Write out and KNOW all your debts from smallest to largest TODAY! Target the smallest debts to take out first.

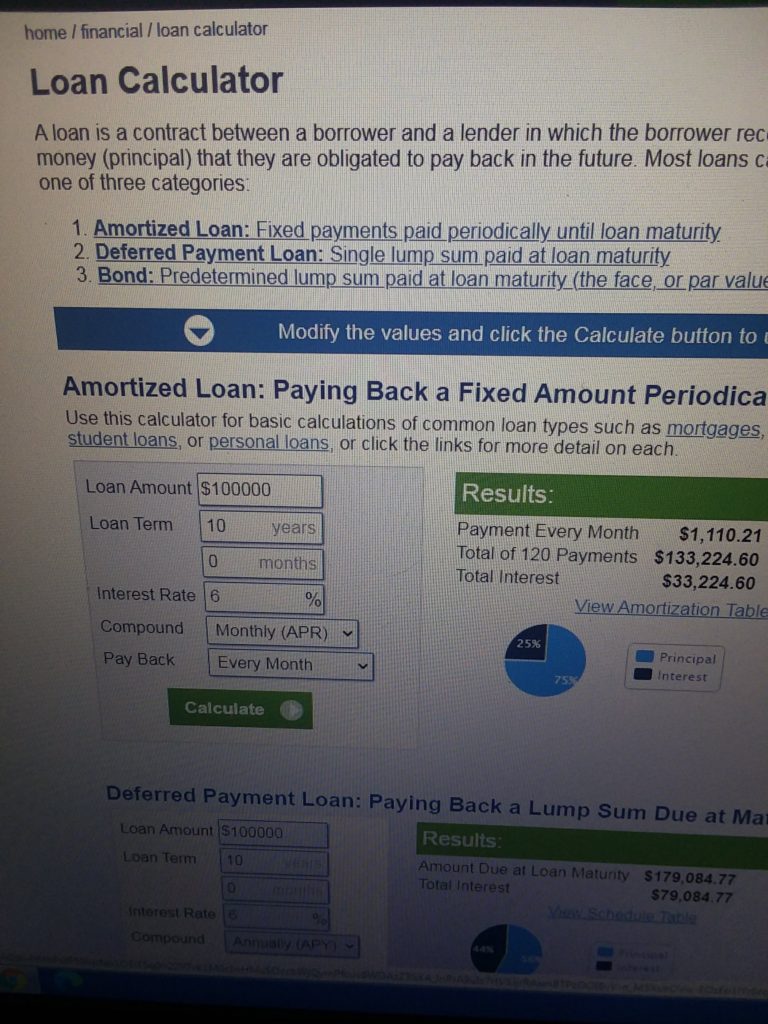

- Use this Free Loan Calculator to figure out how much to increase payments to pay off early and save interest. https://www.calculator.net/loan-calculator.html

- Pay off your smallest debt and roll that payment into the next smallest debt’s monthly payment TODAY! Repeat the process!

- Do not borrow any more money! The goal is to be debt-free! Continue making payments and increasing them as you can! Pay cash! After you become debt-free, pay yourself that outgoing monthly amount by putting it into a savings account.

- Learn to say no to impulsive spending TODAY!

In Conclusion

By carrying a large debt load for way too long I limited what I could have done with my own money. Self-control is an asset. I have the dreaded “If only I would have” taken my Dad’s cue and saved instead of trying to “establish credit.” Today, it is a passion of mine to share tools and encourage healthy financial goal setting early on. Even applying them mid-life will improve your financial situation. The good news is that the 8 tools mentioned above when applied to your daily finances will aid you in becoming debt-free. Read my blog post, “Practical Tips To Save You Money,” https://reconfiguringwithgrace.com/?p=1878 to help this process along. Don’t just read these, agree with them, and then not do anything. Apply these 8 get out of debt tools today and become debt-free! It will be one of the best decisions you will ever make. Start now! Start today!

Very good advice and helpful too.

Very good advice and helpful too.