It pays big dividends to make time to monitor your financial situation. Finances can be very fluid in different stages of your life. An illness, accident, or unexpected loss of your job are all unforeseen events that will definitely affect your income. Educate yourself on the matter for this very reason to strengthen your financial situation. Reconfiguring and adjusting with the ebbs and flow of your personal income will help to keep you in a more stable position. Use these wise reconfiguring strategies to strengthen your financial situation now.

Reconfigure Your Financial Knowledge

Obtain Your Credit Report

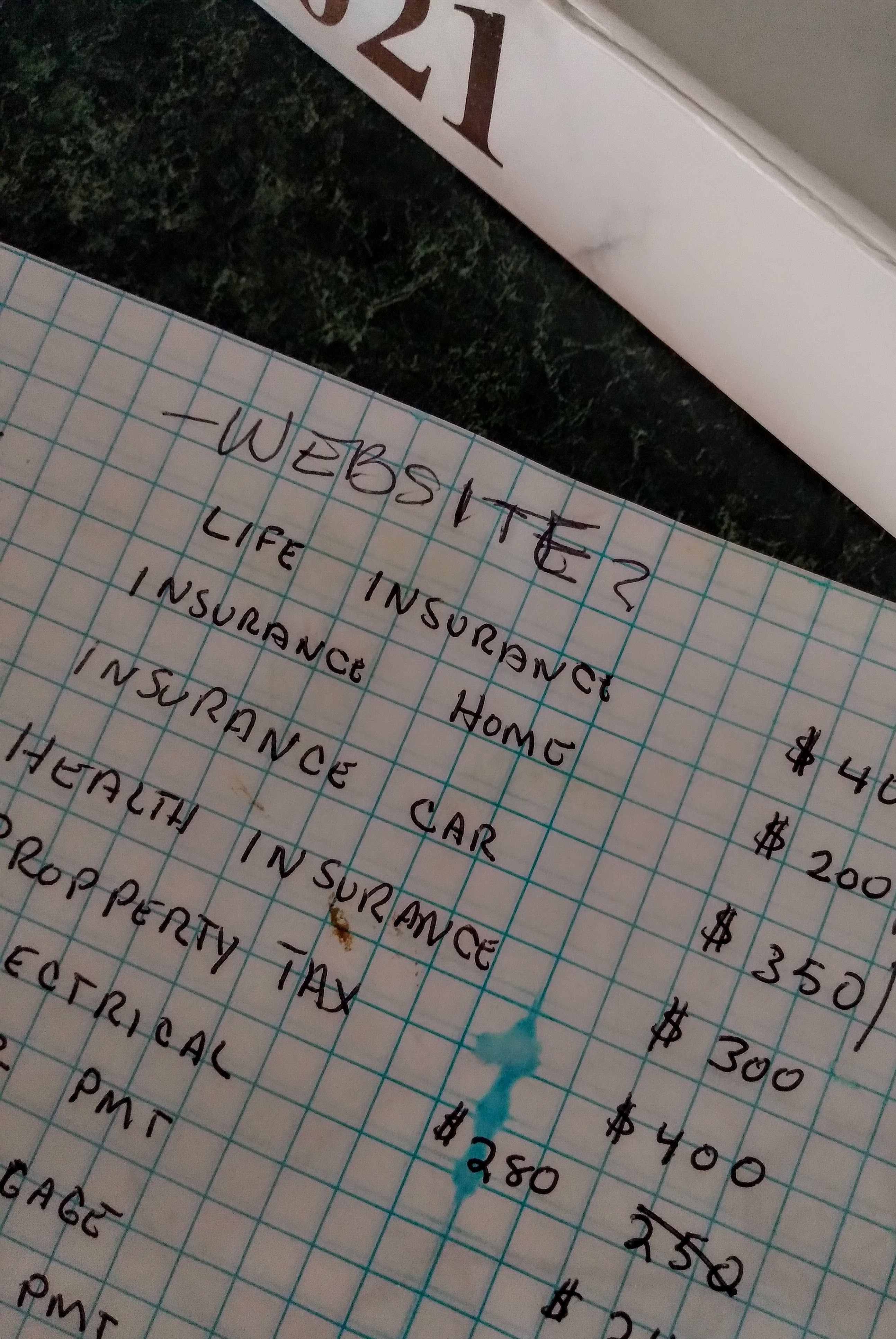

To reconfigure your financial knowledge you have to know where to start. What is your credit score? Who do you owe and how much do you owe them? Obtain your credit report to know exactly where you stand. You may need to contact a few of your creditors to make amends or bring your accounts current. Facing the music might be unpleasant but set goals to repair any adverse scores and you will be glad that you did. You cannot fix what you will not face. Go for it! A clean slate is a great place to start.

What Does The Bible Say About Money

Study what the Bible says about money. The Bible has God’s view on money and how it should be used. Money is a power tool that can help build or be a destructive force in your life. God’s word will help put the powerful tool of money in the proper perspective and place in your heart, mind, and life. The Bible has the best advice regarding money and should be the first inquiry when it comes to financial wisdom.

Keep Sound Financial Advice In Constant View

Subscribe to a financial group like Dave Ramsey to reconfigure your overall financial picture. Listening to podcasts or reading regular emails with financial advice will help keep your mind focused on the big picture. Listening to testimonies of others who are in the same financial place can be encouraging. Their tips and tricks might be a big help to you. Take time to read about proper, healthy financial planning. Keep sound financial advice in constant view to stay on track. Financial knowledge that was not taught growing up can be gained by doing this. You cannot help what you were not taught as a child, but as an adult, there is no excuse not to learn what you need to know about your own money. No excuses! Be a responsible adult and sign up!

Reconfigure Your Debt Goals

Vow Not To Go Further Into Debt

Make a vow not to go further into debt. You might not be able to work a second job but you certainly can make a promise to yourself not to buy anything else on credit. It may be an adjustment at first. Once you begin to put this strategy into motion it will keep more of your money in your bank account by not having to pay interest on the purchase because you used your credit card. Be smart! Be good to yourself. You work hard for your money! Do not be willing to add an additional 8 – 30% profit for the bank’s benefit because you chose to use credit instead of paying as you go. Debit instead and keep the mark up difference in your pocket.

Close Dormant Accounts

Close dormant accounts. Dormant accounts pose a huge potential risk for fraudulent charges and potential lenders see this as possible future debt requiring payment. This is an excellent tactic to use to easily raise your credit score. It closes the door to possible fraudulent charges. Lenders will no longer see those dormant accounts as a potential future payment to consider.

Be Aware How Your Payments Are Being Applied

Be aware of the way your monthly payment is being applied to each debt. A payment is usually divided between the interest accumulated and the principle balance. Guess who gets paid first out of the payment? They do. That financial institution wants you to continue being in debt so they can continue earning their interest. The larger the debt the larger the amount of accumulated interest that goes into their pocket from your monthly payment. Find ways to lessen their profit and keep that money in your hand! Not in their hand! Even increasing your monthly payment by $10.00 each month will save interest and would be applied to your debt balance.

Pray For A Way To Subsidize Your Income

Pray for a way to subsidize your income with another opportunity to earn money. Find a simple side job to earn some extra income. This could be a yard sale, Ebay, or Etsy where you set the scheduled work time yourself. Apply this “extra” income to the smallest debt balance until it is paid off completely. Every little bit helps when you are trying to get out of debt.

Reconfigure What Is Actually Needed

Cut Out Non-Essential Spending

Cut out all non essentials. Non essentials include eating out several times a week instead of menu planning and cooking at home. Non essentials are things like soda, retail therapy to make yourself feel better when you are bored, and buying another of the same thing that you already have 2 or 3 of at home. Cable TV, the latest cosmetic or diet crazed item are further examples of non essential, not needed, not necessary spending.

Make Due With What You Have

Make due with what you have. Learn ways to dress up a basic pair of jeans or black slacks in your wardrobe. Repurpose that piece of furniture to another room. Keep the vehicle that you just paid off for another year. Learn to sew and repair clothing instead of heading to the store to purchase another on credit. Find new ways to be frugal with what you have or need. Shop your home closets, pantry, garage and attic before deciding to spend on something new.

Stop Spending

Plan a season of low to no spending until you are out of debt. This season can be a short heavy duty sprint while applying every extra cent to pay off a loan balance. This season can also be a longer less intense period that is not as uncomfortable. The point is that we often spend out of boredom, peer pressure, or a good advertisement campaign. Plan to stay away from as many advertisements that you can. Turn off the TV, scroll past the Facebook and YouTube ads, and avoid going into the stores unless you really need something. Make a list and get only what you wrote down to get. Be brutal. This planned season will eventually pass and you will be debt free!

Create A Boredom Buster List

Make a list of at least 25 things you can enjoy that passes time. Refer back to this list when boredom strikes instead of being tempted to spend. Learn to make your favorite coffee, cook your favorite meal, and bake your favorite desert. Pick up a good book and start reading. Play board games with your family. Start that exercise plan that you been meaning to but haven’t. Start planning that yard sale to earn extra money. You get the point!

Reconfigure Your Savings Plan

Become A Saver

Discipline yourself to become an avid saver instead of a spender. Our society has conditioned us to be spenders. If you don’t believe that just compare this generation to the generation that survived the Great Depression. That generation learned quickly how to become savers for the things that were needed. Granted The Great Depression happened almost a hundred years ago but the principles still apply today. Benjamin Franklin coined the phrase, “A penny saved is a penny earned.” A wise person will apply this lesson even though it was penned well over two hundred years ago. Good advice never goes out of style! Start saving today even if it is just a small amount.

Open A Retirement Account

Opening up a Retirement Account, in addition to having possible benefits when you file your income tax, is a smart move. Declining health makes working difficult or even impossible in senior years. Planning for that season is an universally wise idea. The younger you start the better off you will be at retirement time. It is never too late to begin. Don’t let your age detour you from starting today.

Save An Emergency Or Rainy Day Fund

Save a good sized emergency fund. Everybody runs into a rainy day from time to time. Just this week my washing machine started acting up and after paying a sizeable fee to have a repairman out to look at it, I found out that it would cost as much to fix as if I bought a new one. On top of that, my dishwasher just stopped. Two major appliances inside of one week. Glad I have an emergency fund to help cover the cost of these much needed appliances. Let’s not even begin discussing the issue of vehicle maintenance and repairs. That can be a hurricane instead of just a rainy day so you might want to get started on it before the rainstorm hits.

Reconfigure Your Giving

Tithe

Tithing is a Biblical command that acknowledges that God is the one who gives you the ability to learn, the physical health to work, and who brings the opportunities to earn a living. Tithing simple means giving 10% of your income to support your church. While it may sound counter productive to tithe it is important to know that you cannot out give God. It is a matter of obedience to His word that He promises to bless in return.

Bring ye all the tithes into the storehouse, that there may be meat in mine house, and prove me now herewith, saith the Lord of hosts, if I will not open you the windows of heaven, and pour you out a blessing, that there shall not be room enough to receive it.

Malachi 3:10 (KJV)

Give To Community Food Banks

Giving to community food banks is a way to bless those less fortunate. Dry goods like spaghetti, boxed mac-n-cheese, Ramen noodles and canned goods are always in need. The less fortunate are all around. By giving you are sowing a seed for a possible future time that you yourself may need assistance. The Bible says that we will reap what we sow and that God sees all of our deeds. One day you might need some kindness when you are in a crisis. Find a way to generously support your local food banks.

Give Gently Worn Clothing To Shelters

Giving gently worn clothing to homeless shelters is one way of really putting to use what you no longer have use for. Donations are regularly accepted to help meet the needs of the homeless. Regardless of the reason that they are homeless your kindness goes a long way.

And the king shall answer and say unto them, “Verily I say unto you, inasmuch as ye have done it unto one of the least of these my brethren, ye have done it unto me.”

Matthew 25:40 (KJV)

Give Of Your Money And Time To A Charity

Give money to a charity that touches your heart. There are many out there to consider. If you are not sure which one to support then pray and ask the Lord to lead you in making the right decision. Making a donation yourself is only one way to give to a charity. Organize a fund raiser or volunteer with your time and talents. All these things brings a smile to the face of our heavenly Father and I guarantee that He will bless you when you need it the most.

Reconfiguration Summary

Reconfiguring how to utilize money will help you stabilize your overall life. Applying the Biblical principle of staying out of debt is beneficial wisdom for us all. Pray for God’s wisdom in all your financial decisions. Ask the Lord to help you become debt free and stay that way . You might need a mentor or a support group to help you begin and be successful. By educating yourself in this matter, the knowledge gained will be a blessing to pass on to your children and grandchildren. No one can ever have more money going out each month than is coming in. Paying attention to the logistics of utilizing your money is a make or break deal that you cannot afford to ignore for long. It‘s never too late to make a change in the right direction. Begin applying these strategies to wisely reconfigure and strengthen your financial situation today.